The FinOps Chronicles

Written By Saugat Tiwari

Jan 18, 2024

Saugat Tiwari is a results-driven DevOps Engineer specializing in AWS cloud infrastructure, automation, and security, with a proven track record of implementing efficient CI/CD pipelines and optimizing cloud-native solutions while maintaining robust security practices.

Latest Blogs

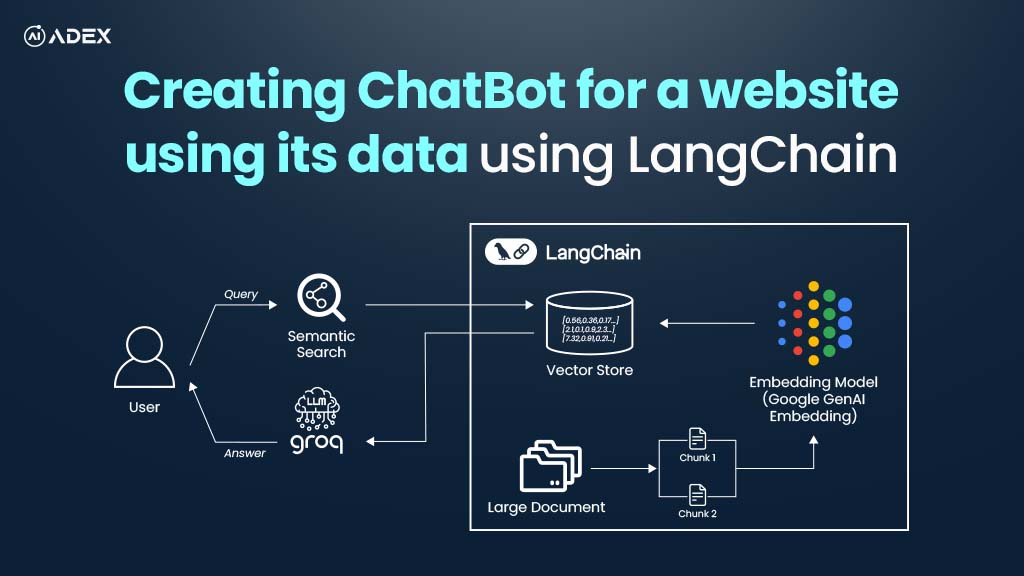

Creating Chatbot For Website with LangChain and Groq

Chatbots are transforming the way users interact with websites and services, helping them navigate c...

Adex International

Aug 21, 2025

Top DevSecOps Practices to Secure Your Cloud Environment

Cloud pipelines evolve rapidly, but every new feature can introduce hidden security risks stemming f...

Chandra Rana

Aug 18, 2025

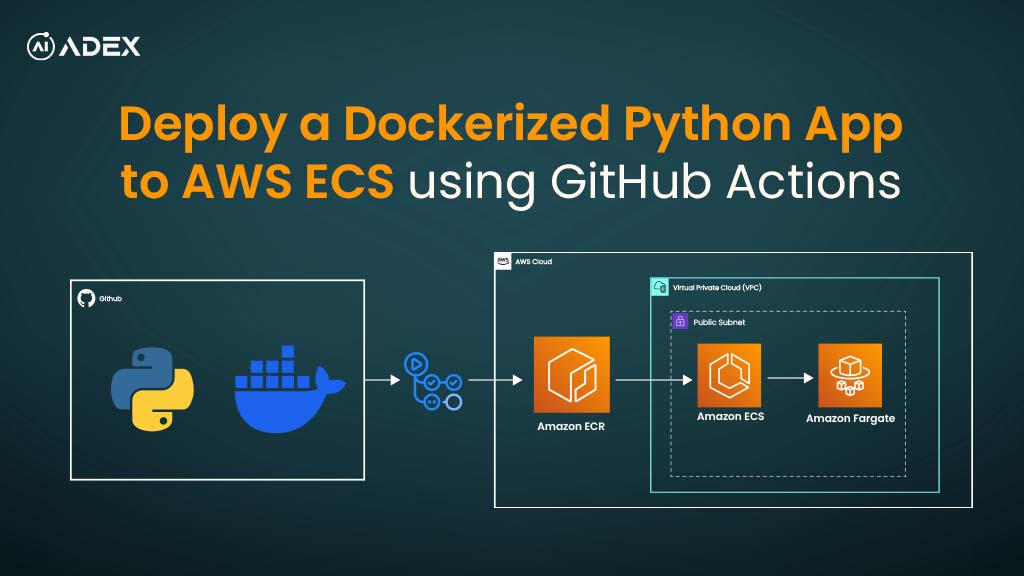

Deploy a Dockerized Python App to AWS ECS Using GitHub Actions

Deploying applications to the cloud reliably can be challenging due to inconsistent environments, sc...

Chandra Rana

Aug 13, 2025

How To Automate AWS Resource Tag Compliance Checks with AWS Config and Terraform

Consistent tagging of AWS resources is vital for governance, cost management, security audits, and o...

Sneha Tuladhar

Aug 08, 2025

AWS Monthly Updates – July 2025: GenAI, Free Tier Boost, and Deployment Enhancements

Redefining what’s possible in the cloud, AWS rolled out its July 2025 updates aimed at accelerating...

Chandra Rana

Aug 05, 2025

Steps to Purchase AWS Reserved Instances: Cut EC2 Costs with Confidence

Did you know businesses can save up to 72% on EC2 costs simply by choosing the right pricing model?...

Prashansa Joshi

Jul 31, 2025

Generative AI Consulting Services: Launch Your Business to New Heights with AI

The pace of business transformation has never been faster, and customer expectations are shifting by...

Adex International

Jul 31, 2025

AI & ML Services for Modern Businesses: Benefits, Service Categories and Partner Evaluation

AI and ML are no longer emerging trends; rather, they are transformative capabilities driving busine...

Adex International

Jul 30, 2025

Offshore Development Centers: Your Guide to Success

Offshore Development Centers (ODCs) are increasingly viewed as a strategic and effective means for f...

Adex International

Jul 29, 2025

Purchasing AWS Savings Plans (1 or 3 year): Step-by-Step Guide for Cloud Cost Optimization

Managing AWS costs has become a top priority as cloud spending continues to outpace other IT expense...

Prashansa Joshi

Jul 21, 2025